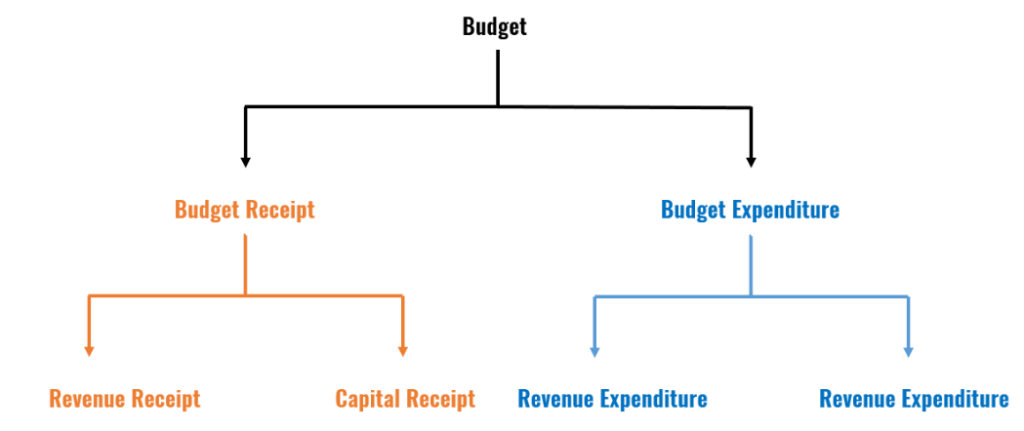

A budget is a financial plan that outlines the estimated income and expenses over a specific period, typically on a monthly or annual basis. It serves as a tool for managing and controlling finances, whether for an individual, a family, a business, or a government. The primary purpose of a budget is to allocate resources in a way that reflects priorities, helps achieve financial goals, and ensures financial stability.

In economics, Budget is the estimation of revenue and expenditure of the government for the given financial period time.

Budget Receipt and Budget Expenditure is the key components of Budget.

Budget receipt

It refers to estimated money receipt of the government from all sources during a fiscal year.

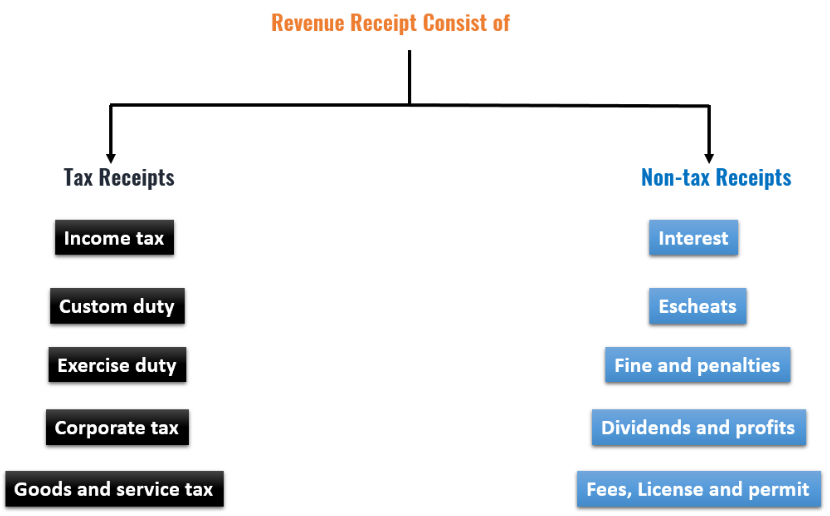

Revenue Receipt

Revenue receipts are those receipts which do not create any liability nor reduce the assets of the government.

- These are the receipts which do not create any corresponding liability for the government. Ex. Unilateral transfer or one sided payment.

- These receipts do not cause any reduction in assets of the government. Ex. When the government sells its shares to companies, like in the case of NFL (National fertilizer limited), Govt. sold 20% of it’s stake but it not cause to reduce the assets of the government.

Revenue Receipt

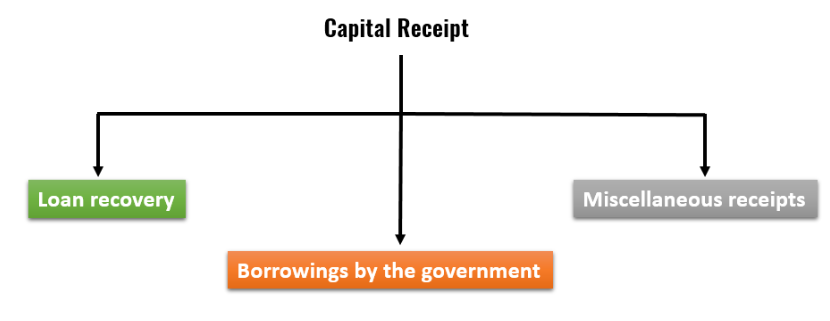

Capital Receipt

Revenue receipts are those receipts which create certain liability and cause a reduction in the assets of the government.

- These receipts are those which give birth to certain liability of the government.

- These receipts are those receipts which cause a reduction in the assets of the government.