The expenditure on the inputs of production, both factor and non-factor, for the production of a commodity is called the cost of production. Examples of factor inputs are land, labour, capital, etc. and examples of non-factor inputs are raw material.

In order to produce any product or service, there is a certain cost involved in the process. Various expenses occur on factors of production (Land, Labour, Capital) or raw material which helps to convert raw material (input) into finished goods (output). All such expenses are what comprise the cost. We can understand factor and non-factor costs as Fixed And Variable Costs:

Fixed cost

The expenditure incurred on employing fixed factors of production, like plant and machinery, is called fixed cost. This cost status is constant for a firm in the short run, and any change in production does not cause any change in the fixed cost of production.

Examples: Rent or lease payments for facilities, salaries of permanent employees, insurance premiums, property taxes, and depreciation on fixed assets are common examples of fixed costs.

Variable Cost

The expenditure incurred on the employment of variable factors of production, like raw material and labour, is called variable cost. The variable cost tends to vary with the change in production

Examples: Raw materials, direct labour, packaging materials, and sales commissions are typical examples of variable costs. The cost per unit for these items remains relatively constant, but the total cost fluctuates based on production or sales volume.

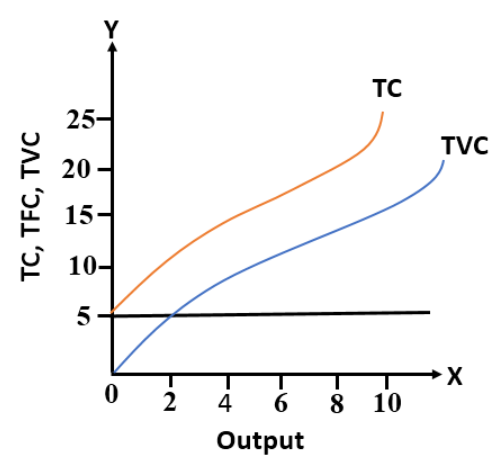

Total cost

It is the summation of Total fixed cost and total variable cost,

Total Cost: Total fixed cost (TFC) + Total variable cost (TVC).

Mathematically, total cost (TC) is the sum of fixed costs (FC) and variable costs (VC):

TC=FC+VC

Here’s a brief explanation of the components:

- Fixed Costs (FC):

- As mentioned earlier, fixed costs are those that do not vary with the level of production or sales. They remain constant over a certain period, regardless of the quantity of goods or services produced.

- Variable Costs (VC):

- Variable costs are expenses that change in direct proportion to the level of production or sales. As the volume of output increases or decreases, variable costs fluctuate accordingly.

- Total Cost (TC):

- Total cost represents the complete expenditure incurred by a business to produce a specific quantity of goods or services. It is the combination of fixed and variable costs.

Importance of Total Cost

Understanding total cost is crucial for various financial analyses, including:

- Breakeven Analysis: Total cost helps calculate the breakeven point, which is the level of production or sales at which total revenue equals total cost. Below the breakeven point, the business incurs a loss; above it, the business makes a profit.

- Profitability Analysis: Businesses assess total cost to determine their profitability. Companies can evaluate the success of their operations by comparing total revenue with total cost.

- Decision-Making: Total cost analysis helps businesses make informed decisions about pricing strategies, production levels, cost-cutting measures, and resource allocation.

In summary, total cost is a comprehensive measure that takes into account both fixed and variable costs, providing a holistic view of the financial implications of a business’s activities.